Will EV stall the machine tool sector?

Explored by Kasra Meharky

In 1895 Thomas Edison, the famous American inventor said, “automobiles are going to be the wave of the future”. This was said one year before Henry Ford built his Quadricycle. Unlike Ford, Edison was completely focused on electric propulsion. He spent years developing a new type of battery which would have overcome the huge problem of mass to energy ratio of the Lead-Acid batteries which were the most common electrical energy storage systems back then. He finally managed to develop his ‘alkaline’ battery which offered a steady stream of electricity in a much more compact and lighter package. Unfortunately, by then, internal combustion engine vehicles (ICE) were widely used on the roads. The events of WWI also played in favour of the ICE cars and Edison’s dream of Electrical Vehicles (EV) didn’t really take off unlike many of his other inventions. Fast forward to the 21st century, and now there is going to be a different picture for EVs on the horizon.

The potential future of electro vehicles as the dominant means of private transportation is one of the most important concerns of the automotive industry. The rapid progress of EV technology through the improvement of batteries and charging infrastructure has painted a bright future for its growth. However, it has also triggered the buzz surrounding its impacts on the automotive sector including the machine tool industry. With automotive parts comprising up to 25 per cent of the global machine tool demand- according to a 2019 study-, the advent of electric vehicles is poised to affect the industry significantly. In this article, I will discuss the ways in which the transition to battery electric vehicles will impact the machine tool industry and the reasons why its toll might not be as devastating as predicted.

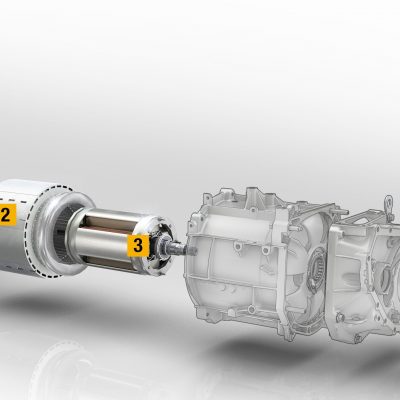

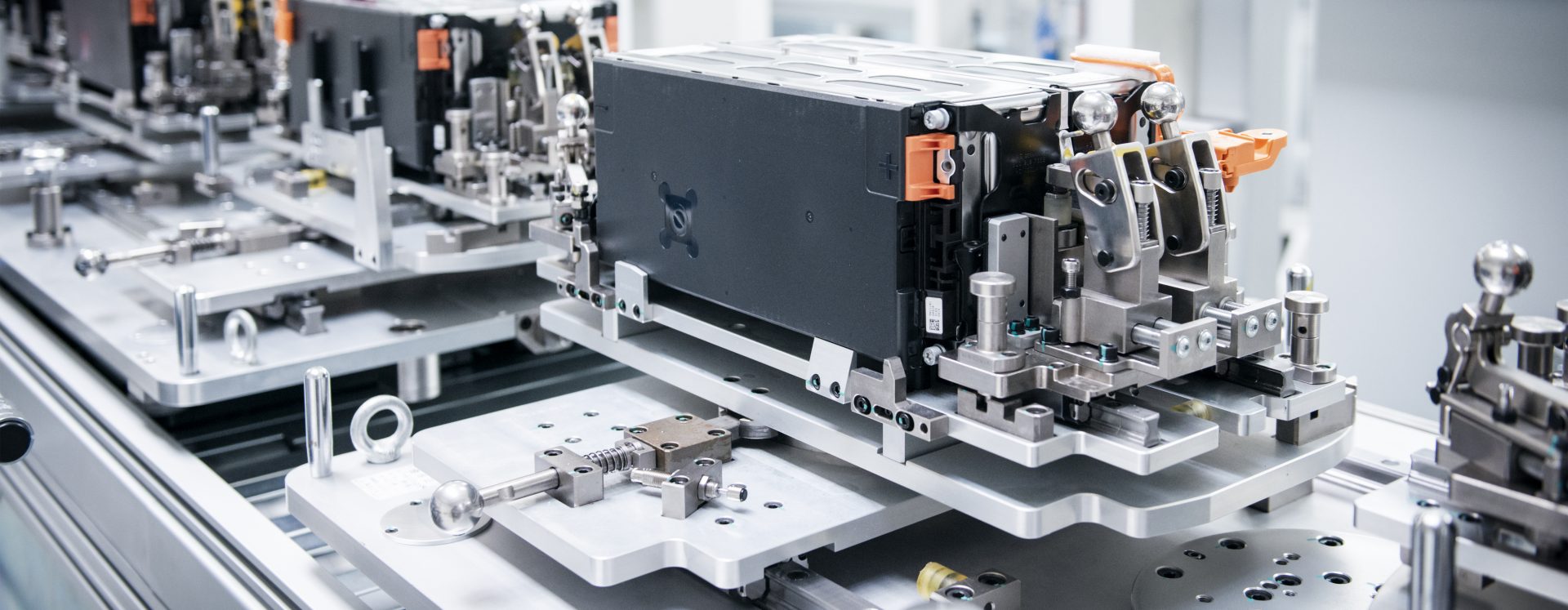

At first glance, there are obvious reasons to concern machine tool manufacturers and shop owners. First is the difference in the number of components in EVs and ICEs. The complex combustion engine vehicles consist of around 1400 components, while battery electric vehicles have around 200. Most significantly, the engine, exhaust and transmission systems, which represent around 1/3 of the automotive supply are replaced with electric motors, battery packs and a much simpler transmission system. Roughly counting, the number of main machined parts in the ICE powertrain, transmission and exhaust system are reduced from 29 to 15 in the EV powertrain, battery and transmission. This leads to an estimated reduction of 60 per cent in metal removal volume in the automotive industry. In addition, the components of Battery Electrical Vehicles (BEV) tend to be more sustainable, reducing production rates even more.

Despite this, there are ways that the effects of component reduction can be mitigated to keep Original Equipment Manufacturers (OEM) and shop owners in the market.

The first thing to consider is substitution by similar industries. Given the intense power and efficiency requirements of almost all other land-based means of transportation such as buses, lorries and trains, the transition to electromobility is much further down the road for these vehicles. With combustion engines staying relevant for these vehicles, a large proportion of the reduction in automotive parts machining can be compensated by components for lorries, buses and other heavy-duty vehicles. A more short-term future for such vehicles is hybrid and plug-in hybrid (PHEV) engines, which in fact will end up benefitting the machine tool industry. The combination of combustion engines with electric drives is a complexity that will create an increased and different need for machining. For instance, more precise gearboxes are required to reduce noise emission and the components have to be more wear-resistant to withstand the sudden loads created when switching from electric drive to the combustion engine. For this reason, it’s reasonable for manufacturers to align their business to serve these substitute industries in the future as well.

The economic aspect of the EV market is what comes next when discussing feasible future strategies for the machine tool industry. The price of electrical vehicles is one of the most prominent aspects contributing to its future success. Similar to any novel technology, such as antilock brakes, stability control features, etc., electric vehicles and any new feature implemented on them are marketed as luxury items before mass production reduces the prices. One good example of this can be the first-ever mass-market car the Ford Model T, which went from 80,000 dollars in 1907 to almost 4000 in 1925. Since the current battery capacity of the BEVs is not nearly sufficient to compete with combustion engine cars and the usage of better batteries is not cost-effective with the current technology, improvement of lithium-ion batteries and the overall BEV technology will reduce the price of the electric cars substantially. Also, the mass production of solid-state batteries, as the next generation of batteries, will definitely contribute to the affordability of electric cars. Furthermore, the considerably low cost of electricity in comparison with fuel, less maintenance and repair costs due to more sustainable components and lower tax rate will keep the Total Cost of Ownership (TCO) of battery electrical vehicles lower than combustion engine vehicles as they face more restrictions on the other side. As a result, electrical vehicles will possibly be available to a larger number of people than current car owners in the future. This way, the rise in demand that follows will offset the reduction in component production compared to the ICE.

Lastly, manufacturers must realise that despite the allure of the transition to electromobility, there are still many barriers including charging infrastructure, battery capacity, cost, etc. Therefore, it might not happen as fast as expected, giving the automotive industry enough time to reinvent itself and adapt to the new demands of the market.

In conclusion, the emergence of electric vehicles as a possible alternative for current ICE cars has undeniably major impacts on the automotive and machine tool industry. While the reduced number of machined components is the main threat to the machine tool industry, there are reasons to consider the effects of the EVs as a change in demands rather than a major setback for the industry. Due to the relatively slower transition of other vehicles such as lorries, getting into those markets is one of the best strategies to consider. Moreover, since the cost of purchase and the total cost of ownership of BEVs will foreseeably be less than ICE cars, the loss caused by the reduced number of machined components will be mitigated by the resulted rise in the availability of cars and demand. With this in mind, the companies must be prepared to change their approach to meet the changes in demands and devise new strategies for the future of their company. After all, when the winds of change are blowing one can either build a wall or a windmill.