LET’S TALK Investment : An Upbeat Assessment

Dave Atkinson, UK head of manufacturing, SME and Mid Corporates at Lloyds Banking Group, talks with contributing editor Steed Webzell about the transition to net zero, post-pandemic recovery and super-deduction tax relief, all of which are driving investment

Climate change poses a risk to every aspect of the planet, threatening to wreak havoc to the natural environment, to communities, livelihoods and the economy. For manufacturers, reducing carbon emissions and achieving net zero is therefore essential. Although the journey to net zero poses several challenges, this transition has the potential to drive investment, innovation, job creation and earnings.

Our UK Manufacturing: Now to Net Zero report published last year found 6% of manufacturers have already achieved net zero, while 47% have set out targets to follow suit, which is a credible ambition when you think about the challenges surrounding expertise, resources and budget,” states Dave Atkinson, UK head of manufacturing at Lloyds Banking Group.

There are many drivers at work here, including one that may prove a surprise.

“During recruitment processes, younger-generation candidates are asking potential employers about their environmental goals, as they only want to work for companies with a credible sustainability story that’s focused on delivering net zero,” says Mr Atkinson. “If manufacturers chose not to travel the road to sustainability, not only will they miss out on cost savings and growth opportunities, but also on new talent.”

Scope 1, 2 and 3 set out ways of categorising different types of carbon emissions. Here, Mr Atkinson suggests Scope 3 is currently “looming large” for SME manufacturers.

“OEMs will soon have to start publicly reporting their Scope 3 emissions, which means they’ll be heavily reliant on supply chain SMEs being net zero, or at least having a roadmap to net zero,” he says. “This is where growth opportunities are emerging: those in the supply chain who can demonstrate net-zero activities are becoming more attractive to OEMs.”

Sure enough, achieving net zero is not easy, particularly with so many other challenges for manufacturers to combat, such as inflation, the energy crisis, supply chain shortages, staffing levels and the ongoing pandemic. However, there is a clear need for manufacturing plants to do something. But where do they start?

In November 2021 Lloyds Bank published ‘From Now to Net Zero: A Practical Guide for SMEs’. The publication sets out a number of defined steps, including: getting started; short-term wins and employee engagement; measure, mobilise and monitor (setting targets and objectives); and navigating the road ahead (tactical investments).

“It almost doesn’t matter where you start, as long as you start,” says Mr Atkinson. “It could as simple as changing your energy supplier to a provider of renewable energy, looking at the type of lighting you use, or setting up more segregated waste streams for recycling. Simple things, but important nonetheless. At Lloyds we have a Green Buildings Tool, an interactive digital portal that can help you identify energy-efficient investments within your buildings.”

A self-audit is among the suggestions for those looking to embark on the journey to net zero. Lloyds recommends engaging the workforce in this activity as they will have ideas on how to improve.

“We offer a Clean Growth Sustainability Audit Guide to help SME manufacturers set out the net-zero process: where am I at the moment, where could I get to, and how can I start this journey?” explains Mr Atkinson. “As a point of note, all of our relationship managers have been through a robust and comprehensive training course with the Cambridge Institute of Sustainability Leadership, so they can have better quality conversations with manufacturers. Ultimately, we have our Clean Growth Financing Initiative, where SME manufacturers can access discounted lending for green purposes.”

Among the success stories is cutting tool specialist Guhring Ltd, which through financial support from Lloyds has invested in five new electric vehicles to bolster its commercial fleet, alongside two hybrid models. The move has the potential to reduce Guhring Ltd’s carbon footprint by more than 25%.

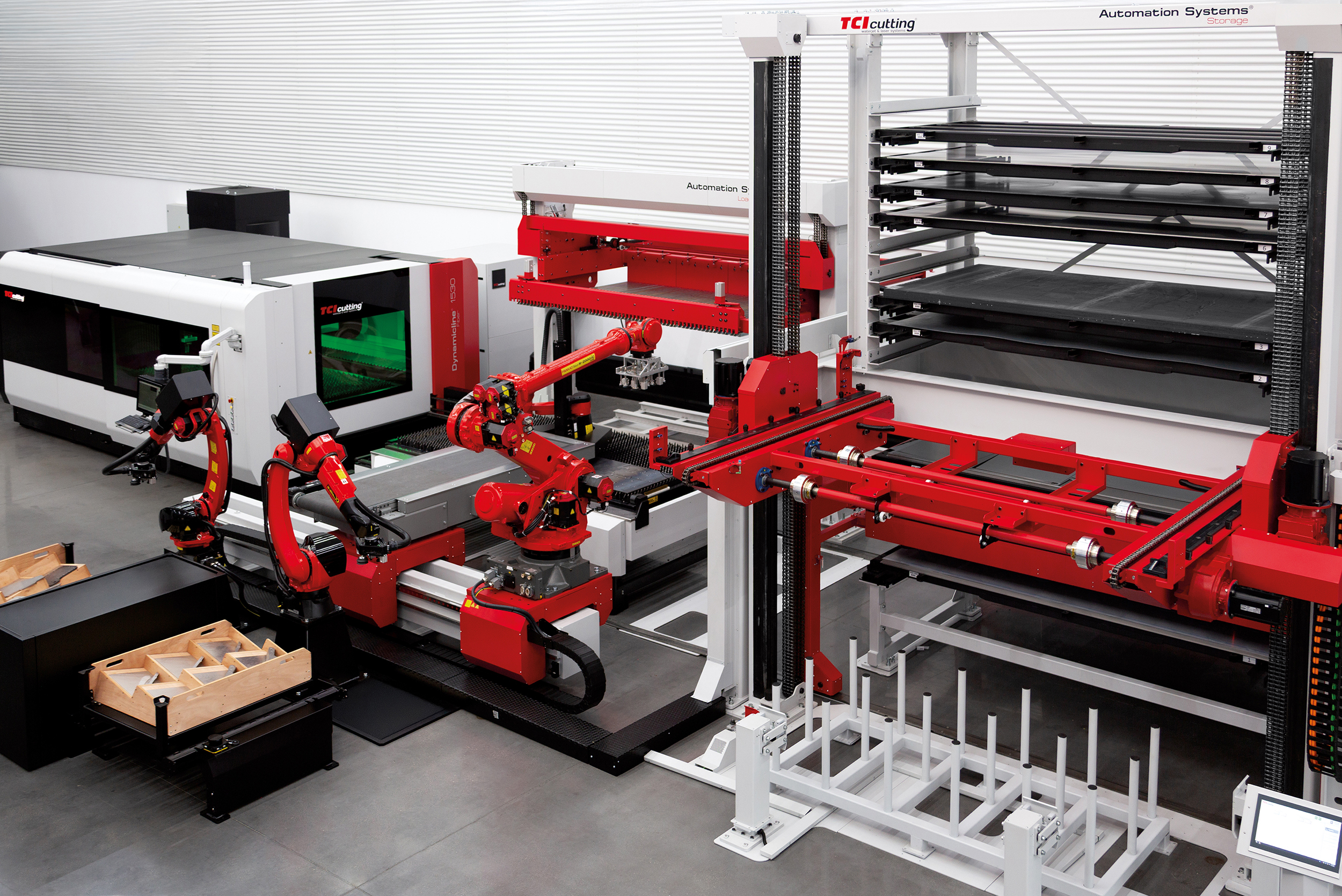

According to Mr Atkinson, those companies that are investing and making the transition to net zero are seeing opportunities in both UK and overseas markets. Any new business opportunities will of course be warmly welcome in the post-pandemic recovery. The challenges of the pandemic left a number of manufacturers using lockdown periods to reflect on their processes and shop-floor layouts. Many also began identifying future investments. For instance, the need to address skills shortages has seen growing investment in intelligent automation and robotics.

Says Mr Atkinson: “We did some work with the MTA (Manufacturing Technologies Association) around four years ago looking at what we call the ‘multiplier effect’ of UK manufacturing businesses. While UK manufacturers employ around 2.6 million people, we discovered they create a further 2.4 million jobs indirectly, plus an additional 2 million roles created through the spending of those direct and indirect employees. So in terms of the sector’s importance, we estimate it’s actually responsible for around 23% of GDP rather than the official figure of 10%. We shouldn’t lose sight of the importance of this sector, and this sector shouldn’t lose sight of the importance of investment. Here at Lloyds we’ve seen good levels of sustained investment across the industry, whether using balance sheet liquidity or funding that we can provide.”

The Government’s super-deduction tax relief is among the drivers of this investment, which according to Mr Atkinson represents a fantastic opportunity for manufacturers.

“We all know that investment in technology and skills drives productivity, and a productive economy leads to higher standards of living,” he says. “I’m sure many have been taking advantage of the super-deduction scheme, which doesn’t end until March 2023, so there’s still time.”

Aside from being the headline sponsor of the MACH exhibition for the past 12 years, Lloyds is clearly not short of manufacturing credentials. Managers at the bank undertake training at WMG (Warwick Manufacturing Group), not to become engineers, but to understand manufacturers better. Lloyds has also invested around £10 million into the Manufacturing Technology Centre (MTC) in Coventry. This investment will support the training and upskilling of around 3500 graduates, engineers and apprentices by the end of 2024. In addition, the bank works with the MTC to offer a manufacturing support service that helps de-risk any potential investments.

“We were founded by two industrialists in Birmingham in 1765, so manufacturing is endemic in our history,” concludes Mr Atkinson. “Sure enough, there are plenty of challenges for manufacturers at present, but in my 34 years of supporting these companies at Lloyds, I’ve learnt about their resilience, agility and determination. When one door closes, manufacturers somehow find the key to open another. I’m really excited about what this sector can achieve in the years ahead.”